The Australian SolidWorks World Conference was the venue for the launch of the 2007 version of SolidWorks. The product has seen continual refinement and development over those 11 years, including several major extensions to its capabilities and scope.

The Australian SolidWorks World Conference was the venue for the launch of the 2007 version of SolidWorks. The product has seen continual refinement and development over those 11 years, including several major extensions to its capabilities and scope.

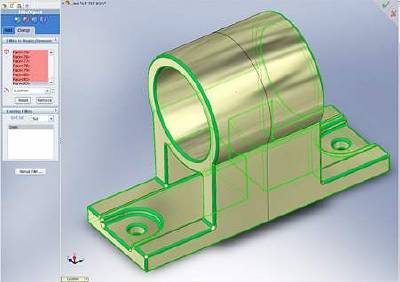

The major areas of enhancement in SolidWorks 2007 are in the tools for surface modeling and manipulation, design analysis and validation, and design assistance.

The analysis tools have been more tightly integrated into the modeling environment, so that designers can very quickly check on the feasibility of ideas as they proceed, instead of having to go into a separate module and then go back into modeling to fix any problems that the analysis revealed. This integration also enables “what-if” ideas to be checked out without having to fully develop a possibility at that stage.

The integrated analysis and validation tools comprise COSMOS works finite element analysis, COSMOS motion kinematics analysis and motion simulation, COSMOS floworks fluid dynamics analysis.

The other major part of the 2007 release is a technology that called SWIFT, which stands for “SolidWorks Intelligent Feature Technology”. This system is designed to provide expert design assistance while designing and to automate some aspects of the design process.

SWIFT Feature Xpert helps the designer to more easily build complex features that rely upon the various component features being modeled in a particular order to achieve the intended result. It can re-order the steps automatically, or guide the build-up process.

SWIFT Sketch Xpert helps in the stage of drawing profile sketches to define solids, by monitoring and resolving dimensional and constraint conflicts and over or under definition of dimensions or constraints. SWIFT Mate Xpert similarly deals with mating conflicts when mating parts are modified.

Vic Leventhal, Dassault Systemes group executive speaking at the SolidWorks World Australia ConferenceDuring the conference I spoke with Vic Leventhal from SolidWorks Corporation. Vic joined SolidWorks in 1995 as Chief Operating Officer. Hence he was greatly involved in the early development of SolidWorks when it was establishing the new market segment for mechanical design software that came to be known as “mid-range” to distinguish it from the existing simple 2D methods and the costly systems for very large scale manufacturing, now dubbed “high-end”. Vic is now Group Executive for Dassault Systèmes, the French parent company that directly produces the “high-end” CATIA mechanical design system.

I asked Vic about about the relationship between SolidWorks and CATIA and markets and capability overlaps. He said there is a quite definite distinction between their fields of application, in a broad sense. CATIA is clearly the globally preferred system for designing planes, ships and automobiles, and excels in supporting huge assemblies and complex manufacturing processes. SolidWorks initially focused solely on designing parts and small assemblies but has expanded that scope to much larger assemblies and a greater range of types of parts, so its market is mainly general manufacturing and makers of custom engineering equipment such as in mining and agriculture. He said there was today there is some overlap of capability and the overlap is getting bigger as SolidWorks expands its capabilities, but the extremely large scale coordination and assembly modeling needed for big complex products like aircraft and submarines will certainly remain the province of CATIA, as will its large scale PLM support – ‘Product Lifecycle management’

Vic commented that although SolidWorks may be considered to have established the “mid-range” product segment, it has evolved so much toward the capabilities of the “high-end” products that he now prefers to describe SolidWorks as a “Mainstream” design product.

I asked how he saw the main focus of further development for SolidWorks. His reply was that their aim has always been, and will remain, to provide the greatest value for money rather than aiming to be the lowest cost option. He said he feels sure that one reason for their success in the market with this strategy is that the company is 100% focused on mechanical design and employs staff who are qualified and experienced in that field in practical ways.

For quite a number of years now the makers of 3D design software have been trying to convince 2D CAD users that there are advantages in moving to 3D methods. Overall, 2D CAD users have not been very enthusiastic about making the change, I think. Vic agreed that the greater complexity involved, especially when users first tried 3D with general-purpose 2D/3D software had put many off the idea. That is why SolidWorks has always placed great emphasis on making 3D modeling operations as self-evident and straight-forward as possible.

For quite a number of years now the makers of 3D design software have been trying to convince 2D CAD users that there are advantages in moving to 3D methods. Overall, 2D CAD users have not been very enthusiastic about making the change, I think. Vic agreed that the greater complexity involved, especially when users first tried 3D with general-purpose 2D/3D software had put many off the idea. That is why SolidWorks has always placed great emphasis on making 3D modeling operations as self-evident and straight-forward as possible.

In its first few years of existence, most sales of SolidWorks were to existing users of “high-end” 3D mechanical design systems, which were often quite hard to learn and use . Today, most new sales are to existing users of 2D systems, moving to 3D design methodology.

It used to be a common situation in moderately large design offices to find a few high-end 3D design stations and a large number of 2D CAD stations, all working on parts of the same product. Today, the trend is toward a wholly 3D design office, now that cost and training is less of a hurdle and there is less reliance on 2D paper drawings for final output to the workshops.

The SolidWorks team recognizes that there will always be some aspects of a design office’s work that can expeditiously be done in 2D, and a need for interchange of data with 2D based companies. So they have recently added a suite of tools for 2D drafting that integrates well with the SolidWorks 3D environment. This is called the “DWG Gateway Series”, which as the name implies, operates with the universal 2D standard DWG file format. Some of these tools are offered for free download to anyone. Others are free to registered users of SolidWorks.

I asked Vic about the policy of providing design software at low cost to students. He said SolidWorks have found this worthwhile in encouraging the adoption of SolidWorks, and it certainly helps employers when new graduates are already familiar with a suitable product. He said he thought at present the ratio of educational licenses to commercial licenses was around 50/50.

Regarding the Australian market for SolidWorks and other manufacturing design software, Vic said that although it is true that Australia is by no means a big manufacturing nation, there is quite a lot of design and innovation done here, and they don’t see the Australian market as saturating or diminishing. Currently as far as SolidWorks sales are concerned, Australia represents about 1.5% of the world market.

When I asked how he saw the next five years for SolidWorks, he said he thought “we would aim for more growth than our rivals”. He commented that an aspect of SolidWorks sales that he considered very satisfying is the fact that the majority of licenses continue to be in daily use in actual production. This may seem an odd statement, but it contrasts with the situation of some of the rival products. It also of course contributes to the need for users to expand their licenses.

Vic Leventhal expects on-going development of SolidWorks to continue to focus on ease of operation and expansion of the breadth of application of the product – hence his preference for the term “mainstream” rather than “mid-range”.