Long before CAD made its way to the PC, Structural Dynamics Research Corporation – better known as SDRC – was providing software to the mechanical engineering community.

Founded in 1967, SDRC first brought their products to market in the early 1970’s. At that time, both Ford Motor Company and General Motors started using SDRC software for pre and post process analysis.

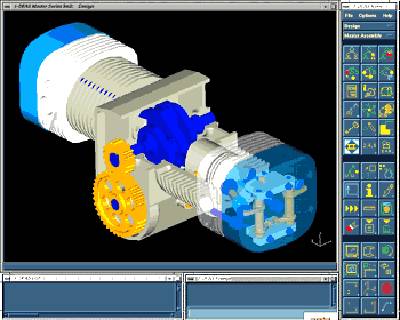

SDRC first introduced their “I-DEAS” software in 1982. Developed by SDRC’s internal product development organization, I-DEAS was created to address the growing MCAE (Mechanical Computer-Aided Engineering) marketplace. In March of 1993, after eleven years of continued growth, SDRC introduced the I-DEAS “Master Series.” This new generation of software products for mechanical design automation was completely re-architectured.

I-DEAS Users

Automotive manufacturers in particular use I-DEAS to design any automotive component or assemblies that lie beneath the Class 1 surfaces of an automobile. The product has also proven itself valuable for designing other aspects of today’s automobiles, such as drive trains, engines, transmissions, chassis components (such as brakes and suspensions, etc.), and seats.

Apart from the Automotive/transportation industry, I-DEAS is also used in the following industries: Aerospace and Defense, Electronics and Consumer Products, Industrial Equipment, and Energy and Process. But the lion’s share of the users (and SDRC revenue) comes from the Automotive industry.

The numbers break down this way:

- 40% Automotive (Ford, Mazda, Nissan, and Johnson Controls)

- 24% Electronics (Seagate, Lexmark, Nokia, and Siemens)

- 22% Industrial Machinery (ABB, NSK, Hitachi, Hoffman Engineering, and Sauer-Sundstrand)

- 14% Aerospace / Defense (Boeing, Lockheed-Martin; British Aerospace, Aerospatial, Orbital Sciences, and Ball Aerospace).

Today’s Challenges

Today, SDRC places a major emphasis on the development and integration of the Imageware line of products into I-DEAS. SDRC acquired Imageware in 1998, and since that time has taken steps to strengthen and integrate the surfacing capabilities into I-DEAS. The ultimate goal of which is to provide an integrated world-class Class 1 and Class 2 surfacing offering.

While SDRC views the CAD marketplace as mature, they still plan to continue to invest in its mechanical design automation offerings. The primary focus of which is to increase user productivity.

A recent result of these efforts has been the new VGX technology. This core technology competency of I-DEAS provides the environment that allows dimensions and constraints to be created and modified at the 3-D part level, and is not limited to 2-D sections as in other competitive software applications. This technology was introduced in 1999 into I-DEAS Variational Analysis and I-DEAS VGX Moldbase.

The Market

The true value of CAD is not in the CAD model itself, but in the surrounding integrated applications that go well beyond creating a model. Customer value is driven through the utilization of a core system, working off a single master model, which provides a greater level of intelligent information that can be managed and leveraged across multiple engineering applications. SDRC views growth opportunities in this market in providing process-centric products and services. Process-centric products and services are closely aligned with the requirements of specific vertical industries.

The true value of CAD is not in the CAD model itself, but in the surrounding integrated applications that go well beyond creating a model. Customer value is driven through the utilization of a core system, working off a single master model, which provides a greater level of intelligent information that can be managed and leveraged across multiple engineering applications. SDRC views growth opportunities in this market in providing process-centric products and services. Process-centric products and services are closely aligned with the requirements of specific vertical industries.

SDRC is targeting the aerospace, automotive, electronics, and industrial equipment industries, with some specific segments, including medical, for instance, under these categories. They have recently reorganized to more closely align with the needs of these verticals. Also, SDRC is establishing “Centers of Excellence” aligned with these industries to expand expertise in delivering value to the vertical market. The first of these is the Aerospace Center of Excellence, announced in the second quarter of 1999, and for all intent and purposes, their Ford Program Office in Detroit, Michigan is an automotive Center of Excellence as well. What’s to Come

The role of an “advanced collaboration environment” will seriously test the resolve of all MCAD software companies. In a true “enterprise product development environment,” there are three specific data areas: creating data, communicating data, and controlling data.

The middle area – communicating data – provides capabilities for rapid iteration, conceptual product modeling, team collaboration, and informal-to-formal information sharing. SDRC believes that this advanced collaboration environment market – or ACE, as they call it – will grow in opportunity size equal to the product data management market in 3-5 years!

PDM considerations aren’t to be taken lightly either. Manufacturers are capitalizing on PDM by tracking configurations so that problem areas can be identified quickly. Of the utmost importance is communicating the latest design changes quickly so individuals are always working on the correct design. Finding parts easily so that re-use, as opposed to re-design, can take place – thus saving time and money.

SDRC believes that the future trends for the PDM market will include:

- The web as the vehicle for communicating across the global enterprise (including suppliers).

- Easy to use/implement, highly visual set of collaboration tools that allows all types of users to interact with the product design data.

- Vertical industry, market segment focused product packages (including services) that are built to meet the specific process requirements in a more “out of the box” manner for companies that don’t require the amount of customization.

There’s also the role of the Internet. SDRC views the Internet as becoming the primary vehicle for companies to communicate with division, suppliers, customers, etc., in order to facilitate the move towards virtual corporations.

CAD/CAM companies use – and will continue to use – the Internet as a means of delivering CAD/CAM/CAE data to the “non-technical data” consumer. This will include delivering product updates or add-on products, marketing demonstrations or product trials, and services or best practices.

The Competition

With the price of a “perpetual license” of I-DEAS modules ranging from $4,000 to $25,000 (with a typical “seat” selling for around $15,000), SDRC is sure to be hit by vendors selling “mid-range” CAD. SDRC licensing is based on concurrent usage of any module in a network. Typical customers will provide core modules (e.g. solid modeling) to each user, and set up modules that aren’t used regularly to be shared.

While SDRC products run on all of the popular platforms like HP (HP-UX), IBM (AIX),

Intel/Windows (Windows NT), Silicon Graphics (IRIX), and SUN (Solaris), so does their competitors software. Furthermore, the overall trend away from UNIX and toward Windows also changes how SDRC will compete with the other “big guns” in the industry.

How SDRC will perform against Dassault (CATIA), EDS (Unigraphics), and PTC (Pro/Engineer) may also depend on the continued growth of the world economy. Several parts of the world have enjoyed steady growth for several years now (especially the US), and if this growth is to take a turn for the worse any time in the near future, than SDRC and the other big MCAD vendors may have to rethink their strategies. Who knows, a big merger may even be the result?

![Home Designer Suite [PC] [Download] 2016](https://www.cadinfo.net/wp/wp-content/uploads/2015/11/512SaYv5N1L.jpg)